Empowering Innovation with AI-Driven

Open Data Solutions.

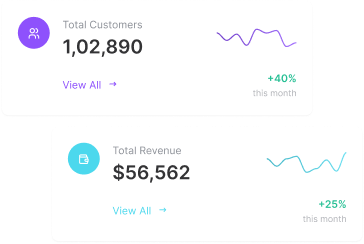

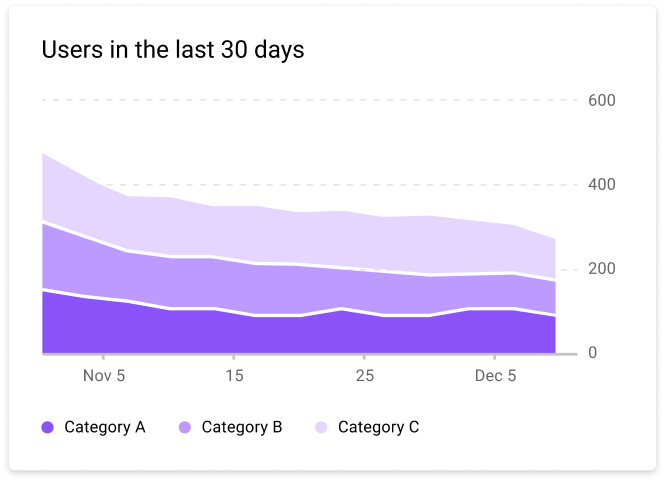

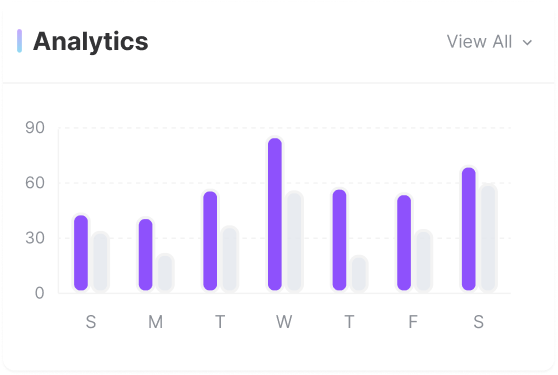

Daily

Data updates and discovery

3M+

Data records

1B +

Data records

updated montly

200

Data source

4

Years in the market

Benefits

Market Intelligence, Redefined

Gain future-ready insights with powerful, self-serve analytics that decode market trends, competitor movements, and user behavior in real time. Designed to help you convert insights into action, and trusted by over 4,000 startups to stay ahead of the curve.

Data-Driven Decisions

Give your team the tools to make strategic choices backed by reliable, actionable data.

Operational Efficiency

Streamline workflows and reduce manual overhead with AI-powered automation and smart analytics.

Smarter Innovation

Uncover new product and market opportunities through intelligent insights and emerging trends.

Personalized Customer Experiences

Gain deeper customer understanding to tailor products and services that exceed expectations.

Proactive Risk Management

Identify and address risks early using predictive analytics and scenario forecasting.

Instant Access to Insights

Stay ahead of the curve with up-to-the-minute data and live intelligence updates.

Products

Unleash the power of Datadock

Transform raw data into actionable market intelligence. DataDock delivers powerful, self-serve analytics to help you uncover growth opportunities, refine product strategy, and outpace the competition. Trusted by 4,000+ startups to convert, engage, and retain users with confidence.

Go-To-Market Intelligence

Craft winning market strategies with AI-powered insights. DataDock.ai uses cutting-edge Natural Language Processing (NLP) to surface hidden patterns and strategic signals from complex datasets—giving your go-to-market teams the edge they need

- Analyze competitor disclosures and product signals across 10+ SEC form types

- Track investor activity by geography, sector, and stage

- Surface emerging market trends using semantic search and NLP

Sanctions & Compliance Monitoring

Stay ahead of regulatory risks with advanced compliance analytics. Uncover critical compliance trends and detect anomalies in real time with intelligent data extraction, correlation, and flagging from relevant sanctions and policy sources

- Monitor global sanctions lists and entity exposure

- Detect patterns in high-risk transactions and third-party relationships

- Automate compliance workflows using real-time rule-based alerts

Real Estate Intelligence

Make smarter property and investment decisions. Leverage enriched datasets and machine learning to identify market opportunities, track development trends, and predict value shifts across regions

- Extract zoning, ownership, and transaction details from public records

- Identify investment trends across commercial and residential markets

- Analyze historical valuations and location-based performance indicators

Private Markets Insights

Illuminate the opaque world of private capital. From Form D filings to 13F holdings, DataDock unlocks deep insights into investment flows, beneficial ownership, and funding activities—empowering investors, VCs, and analysts alike

- Delve deep into your data to uncover valuable insights that were previously hidden.

- Delve deep into your data to uncover valuable insights that were previously hidden.

- Delve deep into your data to uncover valuable insights that were previously hidden.

Real Estate

Sanctions and Compliance

Go-To-Market

Private Markets

Legal Research

Learn How Leading Industries Use Web Data

From GTM teams to top law firms and VC powerhouses, discover how businesses across sectors leverage DataDock’s AI-enriched intelligence to drive action.

Go-To-Market (GTM) Teams

Accelerate pipeline and sharpen positioning.

- Identify high-potential accounts using private placement and funding signals

- Refine ICPs with real-time insights into market activity and executive moves

- Power account-based marketing (ABM) with AI-driven targeting and segmentation

Venture Capital

Invest with sharper signals

- Discover emerging startups via Form D and private placements

- Analyze founder exits, investor activity, and M&A signals

- Monitor capital flows and industry benchmarks in real time

Government & Compliance

Stay aligned and ahead.

- Surface sanctions, PEPs, and regulatory watchlist activity

- Uncover anomalies across financial and procurement data

- Strengthen audit and vendor due diligence processes

Legal & Law Firms

Enhance research and litigation insight.

- Extract structured insights from case law, court dockets, and legal filings

- Perform predictive analytics for litigation trends and case outcomes

- Streamline due diligence and regulatory compliance workflows

Financial Services

Turn filings into foresight.

- Parse 10-Ks, 8-Ks, and 13F reports for critical disclosures

- Track institutional investors and fund strategies

- Support analysts with AI-assisted data extraction and modeling

Commercial Real Estate

See the full picture.

- Monitor asset transfers, zoning updates, and ownership changes

- Analyze real estate investment trends across geographies

- Map portfolios and risk using enriched property data

Testimonials

Don’t just take our word for it

Hear from some of our amazing customers who are building faster

Our recent client and partners

Frequently Asked Questions

We gather information from a diverse mix of open-source databases, proprietary data sets, and partner collaborations. Our broad data pipeline ensures comprehensive coverage, enabling us to provide well-rounded insights tailored to each client’s unique needs.

We employ robust validation protocols that include cross-referencing multiple sources, statistical anomaly detection, and manual reviews by our data specialists. This multi-layered approach helps ensure the reliability and relevance of the data we deliver.

We prioritize the privacy and confidentiality of our clients and their data. We only share information as explicitly agreed upon in our contracts, and we comply with all applicable regulations and industry best practices regarding data handling.

We use industry-standard encryption, secure cloud infrastructure, and stringent access controls to protect sensitive information. Additionally, our security protocols are regularly audited to maintain compliance with emerging standards and regulations.

Our consulting engagements span data strategy development, process optimization, analytics adoption, and technology advisory. We guide organizations in building robust data ecosystems that drive sustainable growth and informed decision-making.

Yes. We specialize in developing tailored software platforms and applications that integrate with existing systems. Our engineering team leverages best-in-class frameworks and a data-driven approach to ensure scalability, reliability, and a seamless user experience.

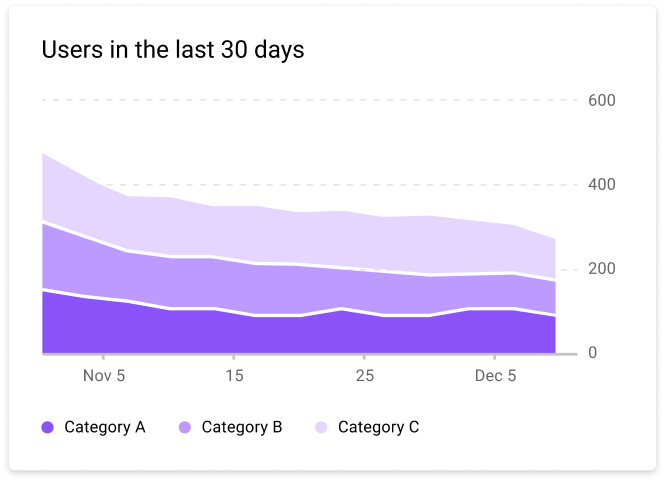

Case Studies & Use Cases

Real-World Applications of Private Markets Intelligence

- Built exclusively on publicly available data, ensuring transparency and compliance

- Designed with strict adherence to global data privacy standards

- Proud founding member of the Ethical Web Data Collection Initiative, setting the bar for responsible data practices

- Committed to user rights enforcement, including a seamless opt-out mechanism for individuals

Our Trusted Partners

Choose how you want to get the data

Real Estate API

- All-enriched data fields

- Unified values

- Easily digestible datasets

- Multiple data formats

SEC API

- All-enriched data fields

- Unified values

- Easily digestible datasets

- Multiple data formats

Sanctions API

- All-enriched data fields

- Unified values

- Easily digestible datasets

- Multiple data formats

DataDock.ai

Empowering Diverse Sectors with Advanced Data and Technology Solutions

Products

Comprehensive Data Solutions

Real Estate-Edge Analytics